Best 11th Commerce Class Coaching in Jaipur

Class 11 is the first step where the foundation of commerce is start. In this class, a student gets aware of Commerce stream which helps in choosing the right career after Class 12th. A wrong path for career choice can lead to disaster in one’s life. So, it is important to study all the subjects in this class sincerely.

This will make your decision about the right career for you. We strive to mold the learning process in such a way that the student can learn basic concepts clearly. We provide lectures that are made interesting by introducing a wide range of examples and diagrams. The student not only learns the theoretical concepts but also develops an understanding of practical concepts. We will provide basic ideas to students like how the financial company works in real life so they will easily get a job.

So are you also facing difficulty finding the best 11th commerce classes in Jaipur? Don’t worry, ASC Classes Jaipur has brought the experienced faculty and best infrastructure for class 11th coaching.

Apart from Class 11th tuition, ASC classes in Jaipur also provide integrated courses for students interested in CA or CMA.

Table of Contents

- Details about 11 commerce coaching classes by ASC Institute

- Subjects details of 11 commerce classes

- Attributes of ASC Jaipur Class 11th coaching

- Class 11th commerce coaching fees

- Admission Procedure of class 11 commerce coaching institute

- FAQ Related to class 11 commerce classes

Admissions Open

Details about 11 commerce coaching classes by ASC Institute

The main aim of ASC Classes is to help its Students in scoring a higher percentage in the examination of class 11 commerce and aims to expand the knowledge and basic concepts of every subject so that students can learn to apply them in real-life situations.

Here you will get details about 11 commerce coaching classes by ASC Classes Jaipur

Class 11th Course Details

Object | ● Course for watering the plants (Career) from the root level. ● Understanding of the subject along with intelligence & creativity. ● The course will built-up a strong base by providing opportunities to develop subject knowledge and intelligence from the earliest age to go for a future career. |

Medium | ● English & Hindi |

Pattern of Study | ● Topics covered in 11thAs per Board Pattern |

Course Duration | ● Class 11th: Year Long |

Mode of Classes | Online and Offline |

Offline Classes at | B-103 Saraswati marg opposite Gandhi Nagar railway station Jaipur, Rajasthan 302015 |

Admissions | Open |

Subjects details of 11 commerce classes

ASC Classes in Jaipur is a great platform for 11th commerce students, which is better than any other coaching center in Jaipur due to its excellence and expertise of faculties in their teaching areas of commerce stream. The students can study senior secondary, graduation as well as professional courses in our ASC classes too. Our hard-working faculties, superior infrastructure, unique mock-test pattern, and skilled video backup facility will bring the quality of teaching and make the students level up.

The great advantage of joining the 11th commerce classes of ASC Jaipur is that we focus on building a solid base of students by providing quality, experienced teaching, personalized guidance, etc.

- The subject list we teach in our 11th commerce classes is

- Accounts

- BST

- Economics

Accounts Course Details

Part A: Financial Accounting 1Unit-1: Theoretical FrameworkIntroduction to Accounting Accounting- concept, objectives, advantages and limitations, types of accounting information; users of accounting information, and their needs. Qualitative Characteristics of Accounting Information. Role of Accounting in Business.

ness Transaction, Capital, Drawings. Liabilities (Non-Current and Current). Assets (Non-Current, Current); Fixed assets (Tangible and Intangible), Expenditure (Capital and Revenue), Expense, Income, Profit, Gain, Loss, Purchase, Sales, Goods, Stock, Debtor, Creditor, Voucher, Discount (Trade discount and Cash Discount)

Theory Base of Accounting Fundamental accounting assumptions: GAAP: Concept

Business Entity, Money Measurement, Going Concerned, Accounting Period, Cost Concept, Dual Aspect, Revenue Recognition, Matching, Full Disclosure, Consistency, Conservatism, Materiality and Objectivity.

System of Accounting: Basis of Accounting: cash basis and accrual basis.

Accounting Standards: Applicability in IndAS Goods and Services Tax (GST): Characteristics and Objective.

Unit-2: Accounting ProcessRecording of Business Transactions

Voucher and Transactions: Source documents and Vouchers, Preparation of Vouchers, Accounting Equation Approach: Meaning and Analysis, Rules of Debit, and Credit.

Recording of Transactions: Books of Original Books of Original Entry- Journal

- Special Purpose books:

- Cash Book: Simple,

- cashbook with bank column and petty cash book

- Purchases book

- Sales book

- Purchases return book

- Sales return book

Note: Including trade discount, freight, and cartage expenses for simple GST calculation.

- Ledger: Format, Posting from journal and subsidiary books, Balancing of accounts.

Depreciation Provisions and Reserves

- Depreciation: Concept, Features, Causes, factors

- Other similar terms: Depletion and Amortisation

- Methods of Depreciation: i. Straight Line Method (SLM) ii. Written Down Value Method (WDV)ge of method

Note: Excluding change of method

- Difference between SLM and WDV;

- Advantages of SLM and WDV

- Accounting treatment of depreciation i. Charging to asset account ii. Creating provision for depreciation/accumulated depreciation account iii. Treatment for disposal of the asset

- Provisions and Reserves: Difference

- Types of Reserves: i. Revenue reserve ii. Capital reserve iii. General reserve iv. Specific reserve v. Secret Reserve

- Difference between capital and revenue reserve

Accounting for Bills of Exchange

Bill of exchange and Promissory Note: Definition, Specimen, Features, Parties.

- Difference between Bill of Exchange and Promissory Note

- Terms in Bill of Exchange: i. Term of Bill ii. Accommodation bill (concept) iii. Days of Grace iv. Date of maturity v. Discounting of bill vi. Endorsement of bill vii. Bill after due date viii. Negotiation ix. Bill sent for collection x. Dishonour of bill xi. Retirement of bill xii. Renewal of bill Accounting Treatment

Note: excluding accounting treatment for accommodation bill Trial balance and Rectification of Errors

- Trial balance: objectives and preparation

(Scope: Trial balance with balance method only)

- Errors: types-errors of omission, commission, principles, and compensating; their effect on Trial Balance.

- Detection and rectification of errors; preparation of suspense account.

Part B: Financial Accounting IIUnit 3: Financial Statements of Sole Proprietorship

- Financial Statements

- Meaning, objectives, and importance;

- Revenue and Capital Receipts; Revenue and Capital Expenditure; Deferred Revenue expenditure.

- Trading and Profit and Loss Account: Gross Profit, Operating Profit, and Net profit.

- Preparation. Balance Sheet: need, grouping, and marshaling of assets and liabilities. Preparation.

- Adjustments in preparation of financial statements with respect to closing stock, outstanding expenses, prepaid expenses, accrued income, income received in advance, depreciation, bad debts, provision for doubtful debts, provision for discount on debtors, Abnormal loss, Goods taken for personal use/staff welfare, interest on capital and managers commission.

- Preparation of Trading and Profit and Loss account and Balance Sheet of a sole proprietorship with adjustments.

Unit 4: Computers in Accounting

- Introduction to computer and accounting information system {AIS}: Introduction to computers (elements, capabilities, limitations of computer system) d profit (loss), assets, and liabilities are to be depicted using a pie chart/bar diagram.

BST (Business Studies)

Part A: Foundation of Business Unit 1: Evolution and Fundamentals of Business

- History of Trade and Commerce in India: Indigenous Banking System, Rise of Intermediaries, Transport, Trading Communities: Merchant Corporations, Major Trade Centres, Major Imports and Exports, Position of Indian Sub-Continent in the World Economy.

- Business – meaning and characteristics

- Business, profession, and employment concept

- Objectives of business

- Classification of business activities – Industry and Commerce

- Industry-types: primary, secondary, tertiary Meaning and subgroups

- Commerce-trade: (types-internal, external; wholesale and retail) and auxiliaries to trade; (banking, insurance, transportation, warehousing, communication, and advertising) – meaning

- Business risk-Concept

Unit 2: Forms of Business organizations

- Sole Proprietorship-Concept, merits, and limitations\

- Partnership-Concept, types, merits, and limitations of partnership, registration of a partnership firm, partnership deed. Types of partners

- Hindu Undivided Family Business: Concept

- Cooperative Societies-Concept, merits, and limitations

- Company – Concept, merits, and limitations; Types: Private, Public and One Person Company – Concept

- Formation of the company – stages, important documents to be used information of a company

Unit 3: Public, Private and Multinational Company

- Public sector and private sector enterprises – Concept

- Forms of public sector enterprises: Departmental Undertakings, Statutory Corporations, and Government Company

- Multinational Company – Feature. Joint ventures, Public-private partnership – concept

Unit 4: Business Services

- Business services – meaning and types. Banking: Types of bank accounts – savings, current, recurring, fixed deposit, and multiple option deposit account

- Banking services with particular reference to Bank Draft, Bank Overdraft, Cash credit. E-Banking meaning, Types of digital payment

- Insurance – Principles. Types – life, health, fire, and marine insurance – concept

Unit 5: Emerging Modes of Business

- E-business: concept, scope, and benefits

Unit 6: Social Responsibility of Business and Business Ethics

- Concept of social responsibility

- Case of social responsibility

- Responsibility towards owners, investors, consumers, employees, government, and community

- Role of business in environmental protection

Part B: Finance and Trade Unit 7: Sources of Business Finance

- Concept of business finance

- Owners’ funds- equity shares, preferences share, retained earnings, Global Depository Receipt (GDR), American Depository Receipt (ADR) and International Depository Receipt (IDR) – concept

- Borrowed funds: debentures and bonds, a loan from a financial institution and commercial banks, public deposits, trade credit,

Unit 8: Small Business and Enterprises

- Entrepreneurship Development (ED): Concept, Characteristics, and Need. Process of Entrepreneurship Development: Start-up India Scheme, ways to fund the start-up. Intellectual Property Rights and Entrepreneurship

- Small-scale enterprise as defined by MSMED Act 2006 (Micro, Small and Medium Enterprise Development Act) )

- Role of small business in India with special reference to rural areas

- Government schemes and agencies for small-scale industries: National Small Industries Corporation (NSIC) and District Industrial Centre (DIC) with special reference to rural, backward areas.

Unit 9: Internal Trade

- Internal trade – meaning and types services rendered by a wholesaler and a retailer

- Large scale retailers-Departmental stores, chain stores – concept

Unit 10: International Trade

- International trade: concept and benefits

- Economics

Part A: Statistics for Economics Unit 1: Introduction

- What is Economics?

- Meaning, scope, functions, and importance of statistics in Economics

Unit 2: Collection, Organisation, and Presentation of data

- Collection of data – sources of data – primary and secondary; how basic data is collected with concepts of Sampling; methods of collecting data; some important sources of secondary data: Census of India and National Sample Survey Organisation.

- Organization of Data: Meaning and types of variables; Frequency Distribution.

- Presentation of Data: Tabular Presentation and Diagrammatic Presentation of Data: (i) Geometric forms (bar diagrams and pie diagrams), (ii) Frequency diagrams (histogram, polygon, and ogive), and (iii) Arithmetic line graphs (time series graph).

Unit 3: Statistical Tools and Interpretation

- Measures of Central Tendency- Arithmetic mean, median and mode

- meaning and properties, scatter diagram; Measures of correlation – Karl Pearson’s method (two variables ungrouped data)

- Introduction to Index Numbers – meaning, types – wholesale price index, consumer price index

- uses of index numbers; Inflation and index numbers.

Part B: Introductory Microeconomics Unit 4: Introduction

- Meaning of microeconomics and macroeconomics; positive and normative economics What is an economy?

- Central problems of an economy: what, how and for whom to produce

- and opportunity cost

Unit 5: Consumer’s Equilibrium and Demand

- Consumer’s equilibrium – meaning of utility, marginal utility, law of diminishing marginal utility, conditions of consumer’s equilibrium using marginal utility analysis.

- Indifference curve analysis of consumer’s equilibrium-the consumer’s budget (budget set and budget line), preferences of the consumer (indifference curve, indifference map) and conditions of consumer’s equilibrium.

- Demand, market demand, determinants of demand, demand schedule, demand curve and its slope, movement along and shifts in the demand curve; price elasticity of demand – factors affecting price elasticity of demand; measurement of price elasticity of demand – percentage-change method.

Unit 6: Producer Behaviour and Supply

- Meaning of Production Function – Short-Run and Long-Run

- Total Product, Average Product, and Marginal Product.

- Returns to a Factor Cost:

- Short-run costs – total cost, total fixed cost, total variable cost; Average cost;

- Average fixed cost, average variable cost, and marginal cost- meaning and their relationships.

- Revenue – total, average and marginal revenue – meaning and their relationship.

- Supply, market supply, determinants of supply, supply schedule, supply curve and its slope, movements along and shifts in the supply curve, price elasticity of supply; measurement of price elasticity of supply – percentage-change method.

Unit 7: Forms of Market and Price Determination under Perfect Competition with simple applications

- Perfect competition – Features; Determination of market equilibrium and effects of shifts in demand and supply.

- Simple Applications of Demand and Supply: Price ceiling, price floor.

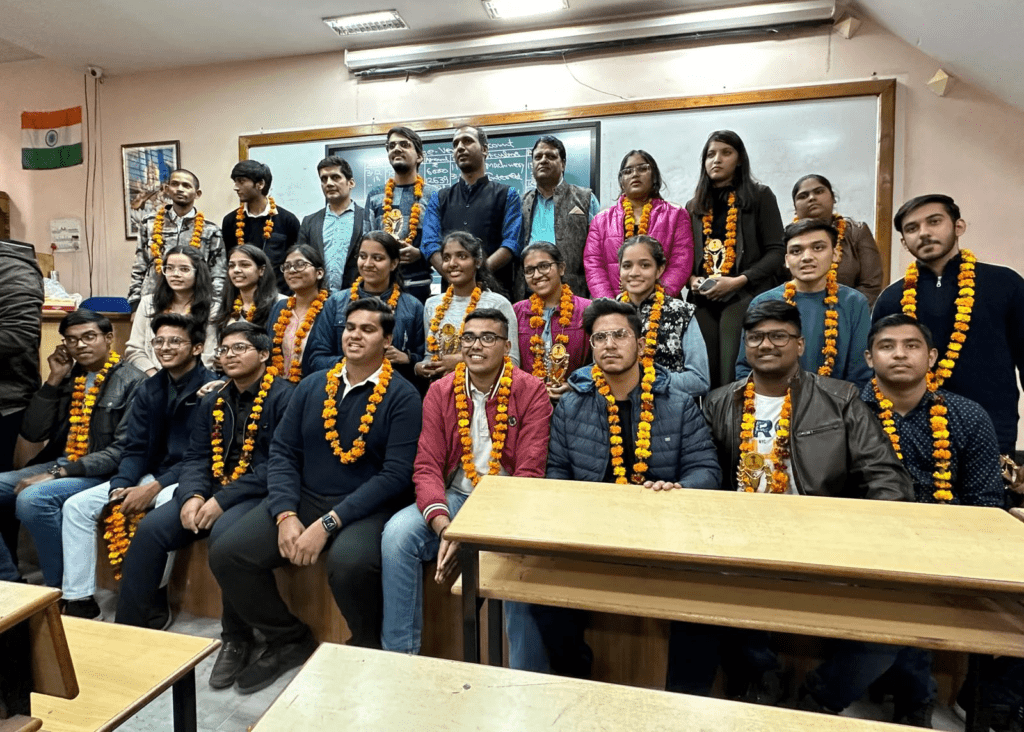

ASC Jaipur’s teaching pattern is highly effective, and it helped our students score more than 90% in classes 11th and 12th. Those students who want to enroll in our new batch can contact us.

Attributes of ASC Jaipur Class 11th coaching

- Timely Covers all the syllabus of particular subjects

- Exam-Oriented Classes from professional teachers

- Regular and Quality Mock Test Papers

- Personalized Guidance to each student according to their performance

- Doubt-solving sessions every week

- Healthy and Competitive Study Environment

- Different Batches for English and Hindi

- Helps students to solve previous years’ papers for practice purposes.

Class 11th commerce coaching fees

CLASS XI | |

Accounts | 11300.00 |

Economics | 11300.00 |

BST | 11300.00 |

All Subjects | 45,200.00 |

Admission Procedure of class 11 commerce coaching institute

You can take admission to ASC offline through Personal Visit or through the online

Admission Procedure by personal visit

Those students who are living in Jaipur can visit our institution and take out the registration form. After that fill in the required details, submit the documents, and pay the fees.

- Directly Visit at the Counselor’s Desk with Photo,

- Fill out the form and deposit the registration fee or the full fee by Cash or any mode of payment(like Phonepay, GPay, or any UPI app)

Admission Procedure by Online

- Download the admission form from the Admission page

- Fill out the form and attach a photo .

- Please send it to our respective Branch where you want to study along with At par cheque / Bank draft/cheque, In favor of Anil Sharma’s classes.

- Deatils about Demo Lectures of Class 11 class

- Here you can check some demo lectures videos so students will a quick idea about our classroom lectures.

FAQs about 11 commerce classes

Preparing for the 11 commerce classes exam and have questions? Don’t worry! We’ve answered the most frequently asked questions to help you understand the course, eligibility, exam pattern, and much more.

Ans. For 11th commerce subjects, ASC Jaipur is the best coaching in India. ASC provides offline and online classes for all subjects.

Ans. Yes. In class 11th, you don’t have the pressure of boards and have sufficient time to build a strong base of commerce concepts from the start.

Ans. There will be two papers on the subject:

Paper I – Theory: 3 hours ……80 marks

Paper-II- Project Work………20 marks